Operating Budget

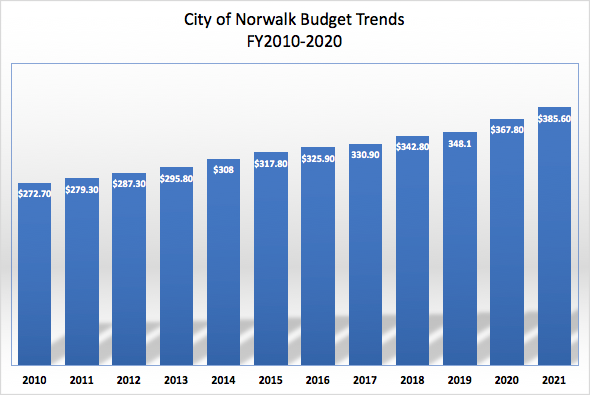

Norwalk’s 2020-21 operating budget has steadily climbed for the past decade. The 2020-21 budget of $385.6M consists of annual operating expenditures for various city departments, including the Board of Education. Third party agencies like the Norwalk Parking Authority, Oak Hills Park Authority, Water Pollution Control Authority, Norwalk Housing Authority, Norwalk Redevelopment Agency, etc. are separate and self-funded, but city taxpayers do provide supplemental funding, usually seen in the capital budget (see separate tab) where the city takes out long term debt and pays for it on a line item in the operating budget. (Note: Major 3rd party agencies highlighted in own tabs.)

Revenue Revenue to run the city is derived predominately from local property taxes via a tax-levy, based upon a mill rate formula. Below is the breakdown of Norwalk’s revenue sources for 2020-21:

- 89% tax levy revenue

- 5% intergovernmental transfer (state & federal)

- 3% departmental receipts

- 2% contingency fund (Rainy Day Fund – previously held tax revenue)

- 1% Miscellaneous

- 0% Interest & Penalties

- 0 % investment income

Expenditures The three biggest expense drivers of the operating budget are the Board of Education, Employee Benefits and Debt Service. City spending in round percentages for 2020-21 breakdown as follows:

- 54% Board of Education

- 8.9% Employee Benefits (ex BOE)

- 8.4% Debt Service

- 6.8% Police Department

- 6.0% Operations & Public Works, Parks & Recreation

- 5.1% Fire Department

- 3.4% Pension Funds (ex BOE)

- 2.4% Community Service

- 1.4% Finance Department

- 1.1% Economic & Community Development

- 1.1% General Government

- 0.7% Contingency (Rainy Day Fund)

- 0.4% Grants

For a breakdown of the Approved 2020-21 Operating Budget:

Personnel salaries makes up the largest portion of the operating budget.